Fraud Surveillance Intelligence Compliance Oversight Unit 3286965186 3295353086 3384800703 3756232303 3510077494 3516659907

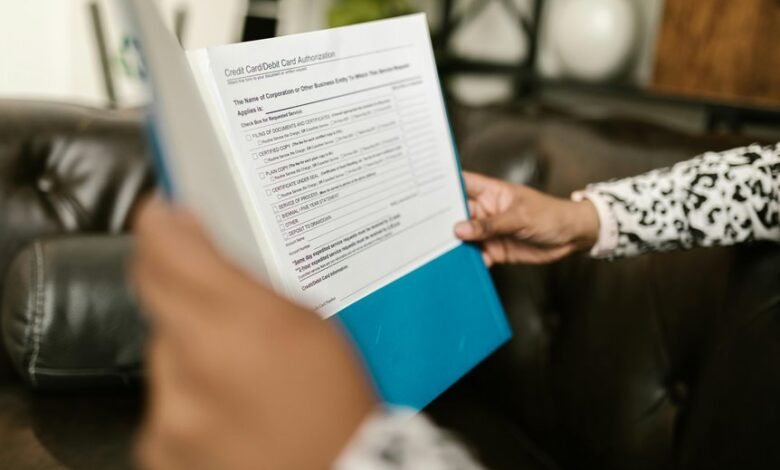

The Fraud Surveillance Intelligence Compliance Oversight Unit, identified by multiple numbers, serves a critical function in modern business environments. By integrating advanced technologies and stringent monitoring practices, it addresses the ever-evolving threat of fraud. Compliance with regulatory standards is paramount, and the unit fosters a culture of accountability within the organization. However, the effectiveness of these measures often hinges on the training and awareness of employees regarding potential threats. What strategies enhance this training and ensure robust security?

The Role of Fraud Surveillance in Modern Business Practices

As businesses increasingly rely on digital transactions, the role of fraud surveillance has become paramount in safeguarding financial integrity.

Effective fraud surveillance necessitates comprehensive employee training to recognize suspicious behaviors and protect data privacy.

Organizations must cultivate a culture of vigilance, where staff are empowered with knowledge to detect potential threats, ensuring that financial transactions remain secure and trustworthy in an increasingly digital landscape.

Advanced Technologies Utilized for Fraud Detection

Leveraging advanced technologies has become essential for enhancing fraud detection capabilities in organizations.

Machine learning algorithms analyze vast datasets to identify patterns indicative of fraudulent behavior, while predictive analytics forecasts potential risks by assessing historical data.

Together, these technologies empower organizations to proactively mitigate threats, ensuring a more secure operational environment and safeguarding assets, thus fostering an atmosphere of freedom and trust among stakeholders.

Compliance Oversight and Regulatory Standards

Advanced technologies in fraud detection necessitate a robust framework for compliance oversight and adherence to regulatory standards.

Effective oversight mechanisms ensure that organizations meet regulatory compliance requirements, thereby minimizing risks associated with fraud.

Building Trust Through Effective Monitoring Strategies

While effective monitoring strategies are essential for fraud detection, they also play a critical role in building trust within an organization.

Implementing trust building techniques enhances monitoring effectiveness, as transparency and accountability foster a culture of integrity.

Conclusion

In conclusion, the Fraud Surveillance Intelligence Compliance Oversight Unit exemplifies the critical intersection of technology and ethics in modern business practices. For instance, a hypothetical case where a retail chain implemented advanced AI algorithms resulted in a 40% reduction in fraudulent transactions within a year showcases the unit’s effectiveness. By prioritizing compliance and investing in employee training, organizations can cultivate a robust defense against fraud, ensuring financial integrity and fostering a culture of accountability.