Fraud Intelligence Compliance Surveillance Oversight Authority 3669872488 3515237322 3888355176 3290755155 3760812313 3716706530

Fraud intelligence has become essential in enhancing compliance surveillance and oversight within organizations. By leveraging unique identifiers, such as 3669872488 and 3515237322, authorities can monitor transactions effectively. This analytical approach identifies anomalies and reinforces compliance protocols. However, as digital threats evolve, the need for advanced strategies in fraud prevention grows. The implications of these developments warrant further examination, particularly in how organizations can adapt to emerging challenges.

The Role of Fraud Intelligence in Modern Compliance

As organizations navigate an increasingly complex regulatory landscape, the integration of fraud intelligence into compliance frameworks has become essential.

Fraud analytics empowers compliance technology by providing real-time insights into potential risks and anomalies. This proactive approach enhances the ability to detect and mitigate fraudulent activities, ensuring organizations remain compliant while fostering an environment that values transparency and accountability.

Ultimately, this promotes greater organizational freedom.

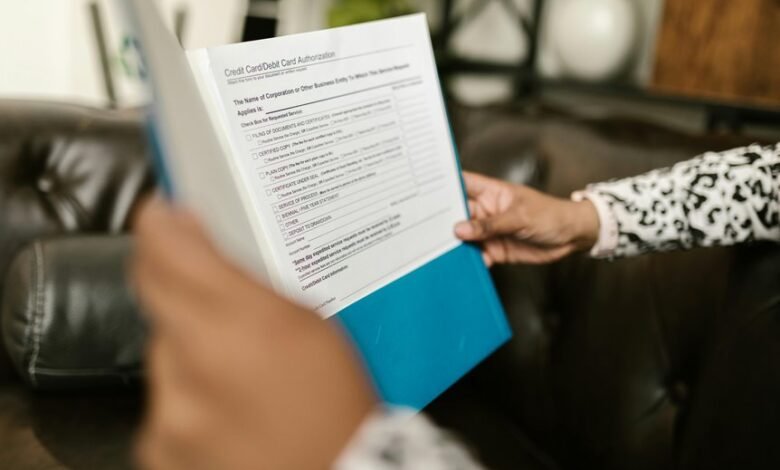

Understanding Unique Identifiers in Fraud Surveillance

Unique identifiers play a critical role in fraud surveillance, as they enable organizations to track, monitor, and analyze individual transactions and entities with precision.

By employing unique identifiers, businesses enhance fraud detection capabilities, allowing for the identification of patterns and anomalies that may indicate fraudulent activities.

This systematic approach fosters a proactive stance against fraud, ultimately safeguarding both organizational integrity and consumer trust.

Strategies for Effective Oversight in Digital Transactions

Effective oversight in digital transactions requires a multifaceted approach that incorporates advanced technology and rigorous policy frameworks.

Implementing robust transaction monitoring systems facilitates real-time analysis, while comprehensive risk assessments identify vulnerabilities and strengthen compliance measures.

The Future of Fraud Prevention and Compliance Measures

The landscape of fraud prevention and compliance measures is evolving rapidly in response to increasingly sophisticated threats and regulatory demands.

Artificial intelligence and machine learning are becoming integral tools, enhancing detection capabilities and predictive analytics.

Conclusion

In the ever-evolving landscape of digital transactions, fraud intelligence serves as a vigilant lighthouse, guiding organizations through turbulent waters of compliance and oversight. By harnessing unique identifiers and advanced analytics, authorities can illuminate hidden anomalies and thwart fraudulent activities before they take root. As the digital realm expands, the integration of robust fraud prevention strategies will be paramount, transforming potential threats into opportunities for trust and transparency, ensuring a secure future for all stakeholders involved.